Navigating eCommerce and Post-Purchase Shipment in Latin America

eCommerce and post-purchase shipping practices differ around the world. This blog series will explore the unique challenges and opportunities in each region. We’ve already tackled North America, Europe, and APAC. In this blog, we’ll focus on Latin America, a region with a rapidly growing eCommerce market.

In this fourth installment of our blog series on eCommerce and post-purchase shipping practices around the world, we’ll be exploring Latin America, a region with a rapidly growing eCommerce market.

Overview of the Latin American eCommerce market

Market Size and Growth Trends for Latin American eCommerce

Latin America's eCommerce market is booming, with a projected annual growth rate of 19% from 2022 to 2027, making it the fastest-growing eCommerce market worldwide. This growth is driven by more internet access, mobile shopping, and digital payment adoption, enhancing the online shopping experience.

By 2024, the market is expected to reach $194.7 billion, and the gross merchandise value will rise from $182.7 billion in 2023 to $269.8 billion by 2028, reflecting an 8.50% annual growth rate.

While the APAC region remains a leader in online retail due to its technological advancements, Latin America’s rapid growth is capturing global attention and investment. As the region embraces digital transformation, it offers exciting opportunities in the evolving eCommerce landscape.

Key Players in Latin American eCommerce

The Latin American eCommerce market is dynamic, featuring several key players:

- Mercado Libre: The leading eCommerce platform in Latin America, operating in 18 countries and boasting over 100 million active buyers, offering a wide range of products and services.

- Amazon: The eCommerce giant has expanded its footprint in Latin America, enabling global sellers to list their products on localized sites such as amazon.com.mx and amazon.com.br, providing diverse options for consumers.

- Americanas: A prominent Brazilian marketplace established in 1999, known for a vast selection of goods and a strong online presence.

- VIA Varejo: A key player in Brazil’s eCommerce sector, offering a variety of products, including electronics and home goods, with a focus on customer service.

- Magalu: An important Brazilian marketplace that combines physical stores with a robust online platform, enhancing the shopping experience for consumers.

- Walmart Mexico (Walmex): A highly popular online marketplace in Mexico, attracting over 80 million monthly visits with a broad assortment of groceries, electronics, and household items.

- Temu: Owned by China-based Pinduoduo Holdings, this marketplace launched in Chile and Mexico in 2023. It aims to offer a wide array of products at competitive prices.

- Shein: A Chinese eCommerce platform rapidly expanding in the Latin American market, especially in Mexico, known for trendy fashion at affordable prices.

Consumer Behavior in Latin American eCommerce

Mobile commerce in Latin America has seen significant growth, with mobile devices accounting for nearly 60% of all eCommerce sales in 2021. Additionally, 57% of the population actively uses mobile internet services. Smartphone adoption reached 79% in 2022, and projections suggest it will increase to 93% by 2030.

Adoption of Social Commerce in Latin America is on the rise. A significant 76% of consumers turn to social media for product research prior to making a purchase. The leading platforms for this research include Instagram (62%), Facebook (61%), Google Shopping (61%), and WhatsApp (37%). Remarkably, over 82% of Latin Americans completed a purchase through a social media site in 2023.

Consumer trust and expectations in Latin America hinge on precise product information, titles, and descriptions. Price and product details significantly influence online purchase decisions, so establishing trust is essential. Consumers heavily rely on online reviews and ratings.

Emerging technologies are transforming retail, with click-and-collect services gaining popularity in the grocery, pharmacy, and fashion sectors. Endless aisle technology is being adopted to broaden product offerings and minimize lost sales, while AI and predictive analytics are increasingly utilized to understand customer preferences and optimize inventory.

Post-Purchase Shipment Practices

After making a purchase, the shipping experience in Latin America can vary quite a bit. This is largely due to the diverse consumer expectations, logistics capabilities, and technological advancements across different countries in the region. Let’s explore some key practices and the differences you might encounter:

| Categories | General Trends | Differences |

|---|---|---|

| Delivery and Logistics |

|

|

| Payment Methods |

|

|

| Cross-Border eCommerce |

|

|

| Customer Experience |

|

|

| Returns and Refunds |

|

|

| Technology Adoption |

|

|

| Regional eCommerce Market |

|

|

| Logistics Challenges |

|

|

Sources:

- https://www.latamclick.com/en/online-consumer-behavior-latin-america/

- https://www.ecommerce-nation.com/ecommerce-landscape-latin-america-opportunities/

- https://blogs.iadb.org/integration-trade/en/eCommerce-in-the-southern-cone/

- https://www.advantagemi.com.pe/latam-ecommerce

- https://www.dhl.com/content/dam/dhl/global/core/documents/pdf/glo-core-ecommerce-latam-en.pdf

- https://cart-power.com/blog/ecommerce-in-latin-america-key-players-and-growth-areas/

- https://nocnocstore.com/cross-border-eCommerce-key-insights-for-2024/

- https://www.mordorintelligence.com/industry-reports/latin-america-eCommerce-logistics-market

Technological Innovations and Trends in Latin American eCommerce

Social commerce is really taking off, with platforms like Instagram, WhatsApp, and Facebook now being used for direct purchases. It's interesting to note that over half of consumers in Brazil, Colombia, and Mexico have already made a purchase through social commerce.

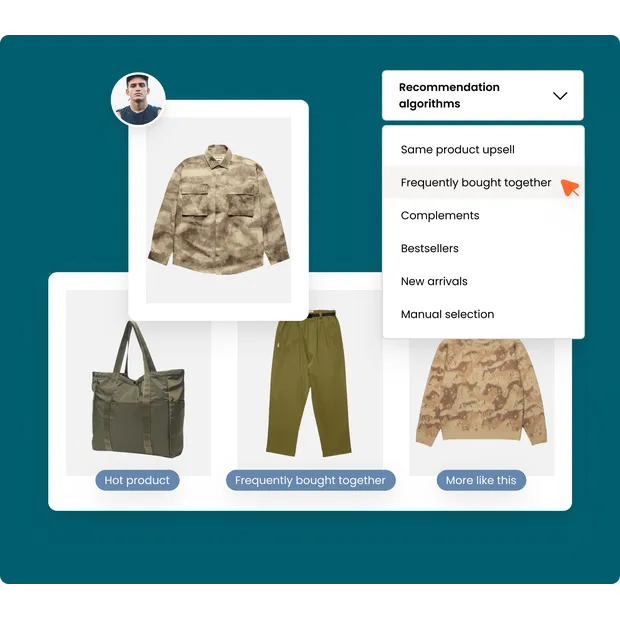

AI and predictive analytics are becoming essential tools for retailers to better understand what consumers want and to optimize their inventory. Tools like AfterShip Intelligence help merchants understand and cater to shoppers’ preferences to deliver incremental revenue.

Logistics and delivery innovations in the eCommerce scene across Latin America are progressing rapidly, with a focus on last-mile delivery and real-time tracking. Companies are investing in local distribution centers to make deliveries faster and more efficient.

Digital payment methods in Latin America are experiencing significant growth, including real-time payments, contactless options, and enhanced security measures. Digital wallets are becoming a favorite, especially among young adults, with 50% of Latin Americans now using card-enabled digital wallets. The region is moving away from cash as businesses roll out innovative omnichannel payment solutions.

Challenges and Solutions for the Future

eCommerce merchants in the Latin America region encounter a range of challenges, but several solutions can assist them. Here are some key challenges and potential remedies:

Logistics and Delivery

Challenge: One of the significant hurdles in logistics today is the inadequate infrastructure combined with last-mile delivery challenges. These issues not only inflate operational costs but also lead to frustrating delays in order fulfillment, ultimately impacting customer satisfaction and loyalty.

Solution: To tackle these challenges, companies should invest in strategically located local distribution centers to boost efficiency and reduce delivery times. Partnering with regional logistics providers can enhance operations, while buy online/pick up in store (BOPIS) options allow customers to skip last-mile delivery, improving convenience and reducing costs. Embracing these strategies helps businesses build a more resilient logistics framework that meets changing consumer demands.

Returns and Consumer Protection

Challenge: High return shipping costs, driven by strict local regulations, pose a significant financial burden for retailers and consumers alike. These expenses can discourage customers from making purchases, ultimately impacting sales and customer satisfaction.

Solution: Create local return centers to simplify the returns process. Allowing customers to return items nearby cuts shipping costs and enhances their experience. Offering store credit or exchanges instead of refunds encourages repeat business and loyalty. These strategies make returns easier and promote a positive shopping experience, leading to better retention and increased revenue.

Language and Localization

Challenge: Effectively localizing content for Spanish and Portuguese-speaking markets can be complex. It's not just about translation; it requires a deep understanding of cultural nuances, idiomatic expressions, and regional preferences to truly resonate with the audience.

Solution: Invest in professional translation services that specialize in your target languages and markets. Collaborate with experts to adapt content to local cultural norms, adjusting references, tone, and visuals. This enhances user engagement and builds trust, leading to better market penetration and business success.

Embracing Opportunities: The Future of eCommerce in Latin America

Latin American eCommerce is evolving rapidly, driven by technological innovations such as social commerce, AI, and enhanced digital payment methods. Despite challenges like infrastructure and high return costs, solutions such as local return centers and professional localization can foster growth. The future is bright for Latin America's eCommerce landscape as it embraces these opportunities.