The State of eCommerce and Post-Purchase Shipment in Europe

eCommerce and post-purchase shipping practices vary across different regions worldwide. This blog series will highlight the unique practices, challenges, and opportunities in each area. In the second installment of our global eCommerce and post-purchase series, we shift our focus to Europe—a region of remarkable diversity and complexity.

Europe presents a fascinating array of eCommerce landscapes, with Western, Central, and Eastern parts of the continent, each possessing unique characteristics and varying levels of market maturity.

By understanding the nuances of Europe's eCommerce ecosystem, businesses can better navigate the intricacies of post-purchase shipment, ultimately improving customer satisfaction and fostering sustainable growth. Below, we delve into the specifics of these regions, offering insights into consumer behavior, technological adoption, and logistical strategies.

Overview of the European eCommerce market

Market Size and Growth Trends

The European eCommerce market is booming, with projections estimating it will reach USD 647.34 billion by 2024 and potentially USD 951.16 billion by 2029, growing annually at 8%. Over the past five years, the industry witnessed a 2.9% growth, reaching €324.9 billion in 2024. The pandemic significantly boosted eCommerce, a 66% sales increase from 2019 to 2021.

Western Europe dominates with over 67% of sales, and the UK boasts the highest online shopping penetration at 95% in 2022. According to research from eCommerce Data Base (ECDB), Europe’s key growth sectors include fashion and electronics.

Looking ahead, despite a brief post-pandemic decline in growth in 2022, the market is set to continue growing, potentially reaching US$955 billion by 2028. Contrary to popular belief that Europe's economies are struggling, the European eCommerce market is large, growing, and driven by clear trends toward expansion.

Key Players

The European eCommerce market is dynamic, featuring several major players:

- Amazon: Dominant in the UK and Germany.

- Competitors:

- Germany: Otto Group, Zalando

- UK, Germany, and France: eBay, Apple

- Competitors:

- Online Groceries:

- UK: Tesco, Sainsbury's

- France: Cdiscount, Carrefour

- Key Players in Other Regions:

- Netherlands: Bol.com

- Furniture Across Europe: Ikea

- Regional Giants:

- Spain: El Corte Inglés

- France: Veepee

European eCommerce is diverse, excelling in segments like fashion, electronics, groceries, and general merchandise. While Amazon remains the most influential, regional competitors such as Otto, Zalando, and Bol.com demonstrate the market's resilience and growth.

Consumer Behavior and Preferences

European eCommerce consumers have specific expectations influencing their online shopping experiences, especially regarding delivery:

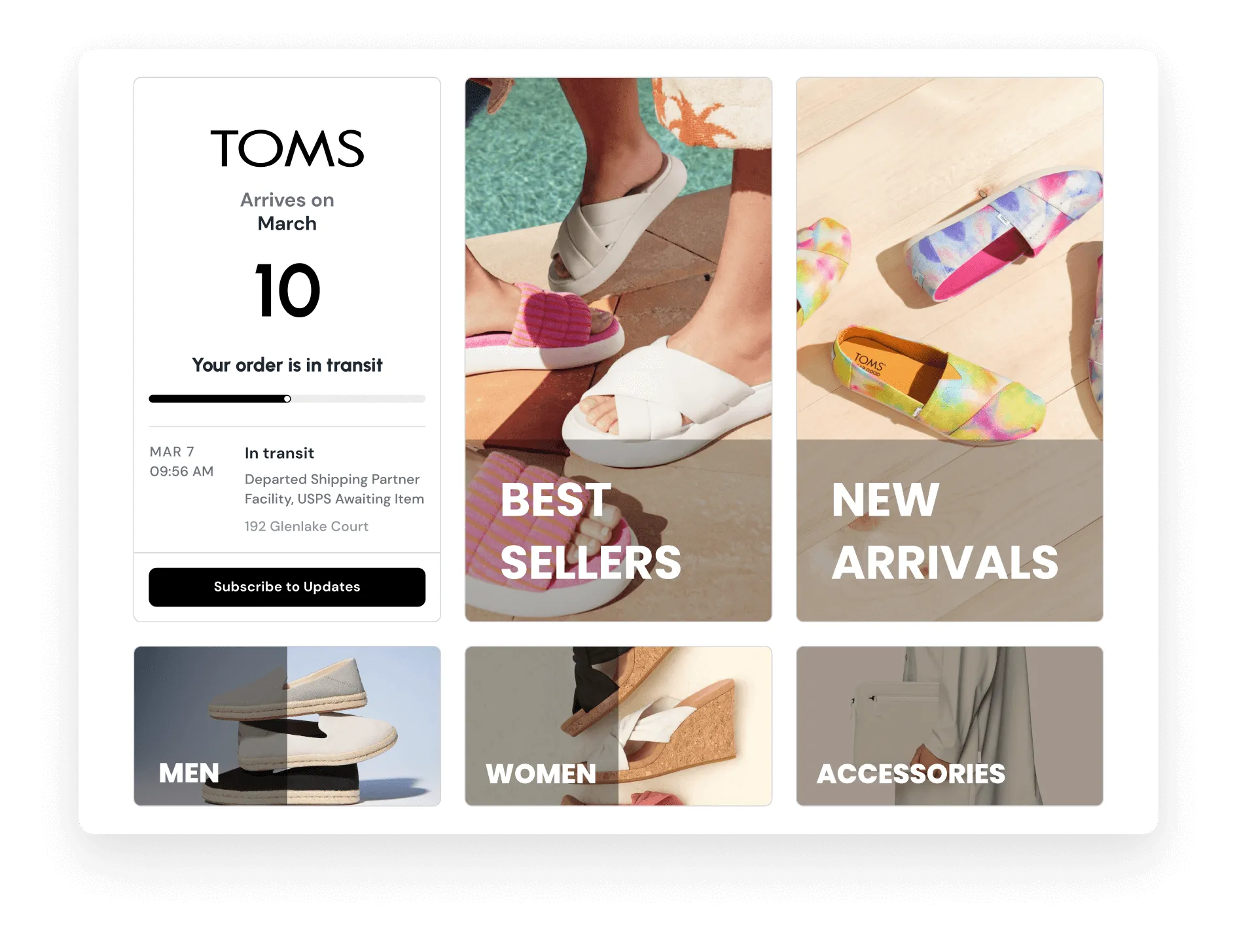

- Delivery Time Expectations: 66% of customers expect parcels within 3-5 days, while 23% prioritize fast delivery and 12% require next-day delivery. Additionally, 26% are willing to pay €3 for expedited delivery.

- Delivery Preferences: 39% prefer home delivery with a signature, while 70% of Spanish shoppers favor this method. Additionally, 50% want to choose the delivery location during purchase.

- Cross-Border Deliveries: 43% find a 3-4 day timeframe acceptable, while Swiss (48%), French (44%), and Italian (43%) shoppers are willing to accept 5-7 days.

- Impact of Delivery Experience: 85% of customers are deterred by poor delivery experiences, and 95% will switch retailers if their preferred delivery options are unavailable.

Post-Pandemic Trends: Convenience drives online purchases for 92% of consumers across 19 European markets, despite delivery anxiety.

Post-Purchase Shipment Practices

Within Europe, post-purchase shipment practices can vary significantly between different regions. Let's examine each country more closely.

Sources:

https://www.pwc.de/de/handel-und-konsumguter/pwc-study-a-major-shift-for-shopping-how-digital-trends-are-transforming-customer-behaviour-in-europe.pdf

https://news.sevensenders.com/hubfs/Consumer Survey 2022/7S-ConsumerSurvey-EN.pdf

https://www.imrg.org/blog/online-shopping-habits-of-the-post-pandemic-eu-consumer/

https://www.emerchantpay.com/insights/exploring-european-ecommerce-trends-and-payment-preferences-to-maximise-revenue/

https://www.clarionpartners.com/insights/european-logistics-why-now

Technological Innovations and Trends

Technological advancements have shaped the European eCommerce market in recent years. Here are some notable trends and innovations to keep an eye on:

Voice commerce

Voice assistants and voice-activated shopping are gaining traction in Europe. Companies are optimizing for voice search and creating interactive voice shopping experiences. This trend is more pronounced in Europe than in other regions.

Sustainability-focused technologies

European eCommerce is placing a strong emphasis on sustainability, driving a wave of technological innovations. These include:

- Tools for calculating and offsetting carbon footprints

- Technologies for eco-friendly packaging

- Systems for transparently communicating sustainability practices

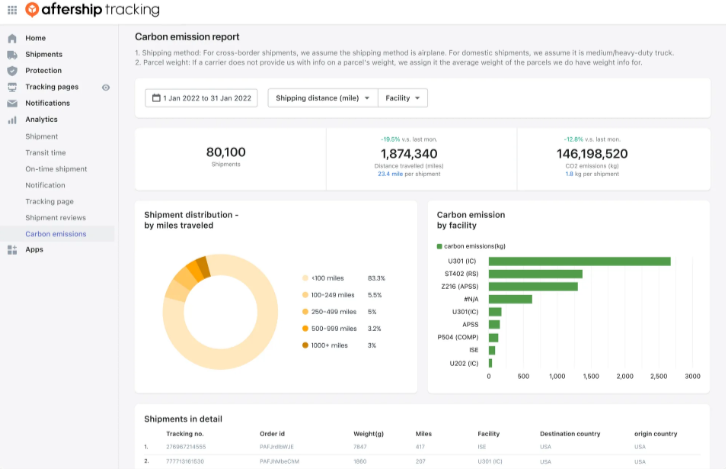

Many companies use carbon footprint accounting software like AfterShip Green to create carbon emissions reports that provide accurate calculations, uncover contributing factors, and improve brand perception.

Cross-border eCommerce solutions:

Europe's unique market structure, with its many neighboring countries, has spurred a focus on technologies that streamline cross-border shopping. Key solutions encompass:

- Multi-currency transactions

- Cross-border logistics and returns management

- Compliance with various VAT regulations across EU member states

Mobile commerce (mCommerce)

mCommerce is booming globally, but it’s particularly robust in Europe. mCommerce is a subset of eCommerce that focuses specifically on transactions conducted via mobile devices. Projections show mCommerce hitting €461.4 billion by 2027, highlighting it as a major area for technological innovation.

Omnichannel integration

Europe is pushing hard for technologies that seamlessly blending online and offline retail experiences. This effort includes:

- Integrating in-store and online inventory systems

- Enabling click-and-collect services

- Ensuring consistent customer experiences across all channels

Personalization technologies vs. privacy

Personalization is trending worldwide, but European companies are especially focused on advanced personalization technologies that adhere to strict EU data protection regulations (GDPR).

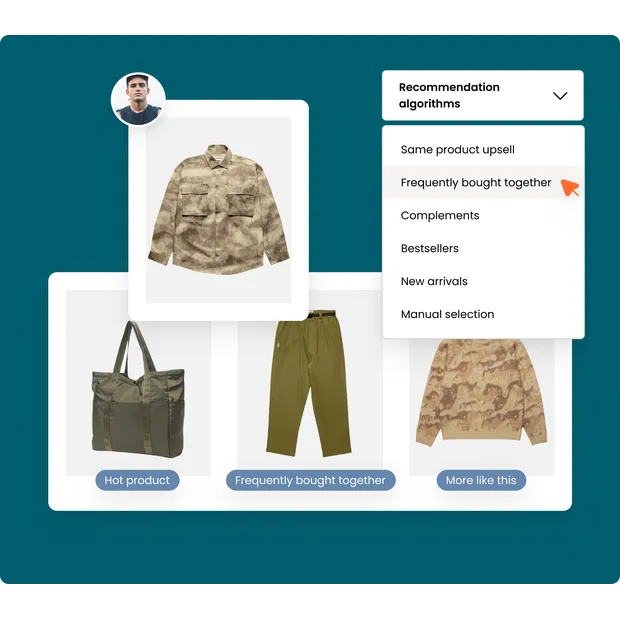

Tools that provide AI-powered product discovery can deliver hyper-personalized shopping experiences that are GDPR-compliant.

Challenges and Solutions

While Europe's eCommerce market is thriving, it also faces unique challenges that require innovative solutions. AfterShip recently ran a customer workshop doing a deep dive into the challenges faced by customers across the European market.

Here are some of the most common problems and potential solutions.

Cross-border logistics

This can be quite challenging, even within the EU's single market. Shipping and returns across borders often remain complex and costly. The diversity in languages, currencies, and consumer preferences across different countries adds to these logistical hurdles.

To overcome these challenges, merchants should consider leveraging European fulfillment networks and partnering with local logistics providers. Implementing advanced inventory management systems can also be a significant advantage. Additionally, offering transparent shipping costs and delivery times will help ensure a smoother experience for your customers.

Market fragmentation

Europe is not a homogeneous market. Consumer behaviors, preferences, and eCommerce adoption rates vary widely between countries. This fragmentation makes it challenging to implement a one-size-fits-all strategy across the continent.

To address this, develop localized marketing strategies tailored to each country. Conduct thorough market research to understand the nuances of each market. Adapt your product offerings to align with local preferences. Additionally, create country-specific websites and apps to better cater to regional needs.

Personalization at scale

European consumers expect personalized shopping experiences, but delivering this at scale while complying with data protection regulations can be complex.

To address this challenge, businesses should leverage AI and machine learning to tailor experiences, implement robust customer data platforms, and use predictive analytics to offer personalized recommendations. It's also crucial to ensure transparency in data usage and provide easy opt-out options for customers.

Major world events

The impacts of Brexit and events like the war in Ukraine have been felt in the European eCommerce market. Brexit has brought several challenges to eCommerce, such as customs delays, longer shipping times, and new tariffs. The Ukraine conflict has further strained supply chains, causing longer lead times and material shortages. Additionally, businesses now emphasize data protection amid growing safety concerns and economic pressures, making consumers more price-sensitive and affecting brand loyalty.

Businesses can mitigate the impact of these events by diversifying their supply chains and exploring new markets. Building trust with consumers through clear communication and robust data protection is equally crucial. Additionally, staying informed about evolving regulations and market conditions will help companies quickly adapt to disruptions.

"EU merchants are focusing more on profitability and cost optimisation when making any purchasing decisions. Through both Brexit and the war in Ukraine, the market was exposed to supply chain challenges which paired with lower appetite amongst consumers to invest, especially when it comes to non-essential goods. Despite all these factors, the eCommerce market is still growing, not as fast though as it was between 2022-2023."

Aga Legowik, Head of Sales Enablement and Operations, AfterShip

Looking Ahead

As the European eCommerce market continues to grow and innovate, we can anticipate further advancements in sustainability-focused technologies, cross-border solutions, and personalization to meet consumer expectations.

Businesses must stay agile and adapt quickly to keep up with these evolving trends and challenges. Use this article as a starting point to stay ahead of the curve.

In our next installment, we’ll delve into the state of eCommerce in the Asia-Pacific markets. Stay tuned!