Navigating eCommerce and Post-Purchase Shipment in the Asia-Pacific Region (APAC)

eCommerce and post-purchase shipping practices differ around the world. This blog series will explore the unique challenges and opportunities in each region. Our first two blogs covered North America and Europe. In this blog, we’ll focus on the diverse and complex Asia-Pacific region.

In the third installment of our series on eCommerce and post-purchase shipment, we’ll focus on the Asia-Pacific region (APAC). APAC is a rapidly growing market for eCommerce, with China, Japan, Australia, and South Korea leading the way. In fact, according to eMarketer, retail eCommerce sales in this region are expected to reach $2.725 trillion by 2021.

This blog will discuss the key factors that contribute to the success of eCommerce in APAC, as well as the challenges faced by businesses in this region regarding post-purchase shipment.

Overview of the APAC eCommerce market

Market Size and Growth Trends for APAC eCommerce

The APAC eCommerce market was valued at approximately USD 3.82 trillion in 2023 and is projected to reach USD 4.20 trillion in 2024. By 2029, the market is expected to grow significantly, reaching an estimated USD 6.76 trillion, driven by a compound annual growth rate (CAGR) of around 10% from 2024 to 2029. Another report suggests a slightly higher CAGR of 10.73% from 2023 to 2028.

This impressive growth is driven by more people going digital, faster and more widespread internet access, and the rise of mobile shopping. China and South Korea, in particular, are expected to see online retail penetration soar past 40% by 2028. The fashion and apparel sector, in particular, is set for significant growth as local trends take off and the focus shifts from Western to developing Asian markets.

Of course, there are challenges like logistics issues, different regulations, and concerns about digital security. But there's also a lot of potential out there, especially with the integration of AI, AR, VR technologies, and the growth of social commerce. Companies that can navigate these hurdles will be able to take advantage of the exciting opportunities in this dynamic eCommerce landscape.

Key Players in APAC eCommerce:

- Alibaba Group: Dominates the market with platforms like Taobao, Tmall, and AliExpress. Leads in retail sales and customer base.

- JD.com: Major player in China with a strong B2C presence and efficient logistics network.

- Amazon: Significant presence in India and Australia, known for its extensive product range and customer service.

- Rakuten: Leading platform in Japan, popular for its loyalty program and diverse offerings.

- Lazada: Prominent in Southeast Asia, especially in Indonesia, Malaysia, and the Philippines, owned by Alibaba.

- Shopee: Leading platform in Southeast Asia and Taiwan, known for its mobile-first approach and competitive pricing.

These companies have leveraged technological advancements, robust logistics networks, and consumer-centric strategies to capture significant market share in the APAC eCommerce landscape. Their ability to adapt to local market conditions and consumer preferences has been crucial to their success.

Consumer Behavior in APAC eCommerce

Value-conscious shopping: Driven by economic uncertainties, APAC consumers are on the hunt for the best deals. They compare prices and read reviews online, embracing "Value Hacking" to find great bargains without sacrificing quality.

Mobile and social commerce: Mobile shopping is huge in APAC, with over 70% of internet users in Southeast Asia buying things on their smartphones. Social media greatly influences these decisions, with more than 50% of consumers making purchases based on influencer recommendations. Platforms like TikTok, WeChat, and Instagram are at the forefront, making shopping easier and more integrated.

Omnichannel shopping: Many consumers in APAC are blending their online and offline shopping experiences. In countries like South Korea, China, and India, there's a strong mix of engagement across various channels, allowing for seamless transitions between online and in-store shopping.

Post-Purchase Shipment Practices

After making a purchase, the way in which shipments are handled in the Asia-Pacific region can differ. This is all thanks to the variety of consumer expectations, logistics capabilities, and tech advancements between countries. Let’s take a look at some important practices and the regional differences:

| Post-Purchase Shipment Practice | General Trends | Regional Differences |

|---|---|---|

| Order tracking and visibility | - 70% of consumers expect detailed order tracking.

- Expectation rises to 82% for international purchases. |

- China: Cross-border solutions like e-CAN facilitate customs clearance. - Japan & South Korea: High demand for tracking accuracy. |

| Delivery speed and efficiency | - Fast delivery is crucial.

- Next-day delivery is a key driver for online purchases. |

Southeast Asia: Emphasis on fast delivery by platforms like Lazada and Shopee.

- Australia & NZ: Geographic challenges impact speed. |

| Convenient delivery points | Extensive networks of pick-up/drop-off points (e.g., FedEx with 200,000 locations across Asia). | Singapore: 99% of residents live within 1 km of a FedEx location, ensuring high convenience. |

| Returns management | - Efficient returns processes are critical.

- Solutions like FedEx Global Returns simplify returns. |

- Southeast Asia: Local platforms offer extensive returns options.

- China: Enhanced customs clearance options for smoother returns. |

Sources:

- https://www.mordorintelligence.com/industry-reports/asia-pacific-freight-logistics-market-study

- https://nielseniq.com/global/en/insights/analysis/2023/consumer-behaviors-driving-the-future-of-eCommerce-in-asia-pacific/

- https://www.mordorintelligence.com/industry-reports/asia-pacific-ecommerce-market

- https://www.statista.com/topics/7121/eCommerce-in-asia-pacific/

- https://anchanto.com/sg/how-to-master-post-purchase-experience-as-a-brand-or-marketplace/

- https://retailasia.com/eCommerce/news/around-3-in-5-apac-consumers-prefer-shopping-online

Technological Innovations and Trends in APAC eCommerce

Platform convergence: One exciting trend in APAC eCommerce is platform convergence. Consumers are increasingly looking for all-in-one shopping experiences that make life easier. This trend has led to a rise in platforms that combine product reviews, purchasing, and payment options all in one place. By offering a smooth and convenient shopping experience, these platforms resonate with convenience-loving shoppers in APAC.

Augmented reality (AR) and virtual reality (VR): This tech is taking off in the APAC region, giving consumers some truly immersive shopping experiences. These cool technologies let users see products in real-world environments, making online shopping more engaging. Whether it's virtual try-ons or 3D product views, AR and VR are closing the gap between shopping in-store and online, which not only boosts customer satisfaction but also helps cut down on return rates.

Cybersecurity measures: With the rise in online transactions, cybersecurity has become a critical focus for eCommerce businesses in APAC. Protecting sensitive customer data from cyber threats is essential, prompting companies to invest heavily in robust security measures. Ensuring data privacy and transaction security protects consumers and fosters trust, which is vital for the continued growth of eCommerce in the region.

– Vivian Liu, Customer Success Manager, Asia-Pacific Region, AfterShip

Challenges and Solutions for the Future

eCommerce merchants in the Asia-Pacific region face various challenges, but some solutions can help. Here are some key challenges and potential fixes:

Challenges:

- Infrastructure and digital readiness: There are gaps in infrastructure and digital readiness, like poor internet connectivity, which slow down eCommerce growth.

- Logistics costs: High logistics costs are a major hurdle for cross-border eCommerce, making timely deliveries tricky.

- Regulatory barriers: Inconsistent rules about data privacy and customs make cross-border transactions difficult.

- Cultural diversity: Different languages and consumer preferences mean eCommerce businesses must localize their offerings to succeed.

- Security concerns: Rising security and privacy worries can deter consumers from shopping online.

Potential Solutions:

- Improve infrastructure: Investing in better internet and mobile networks can bridge the digital divide.

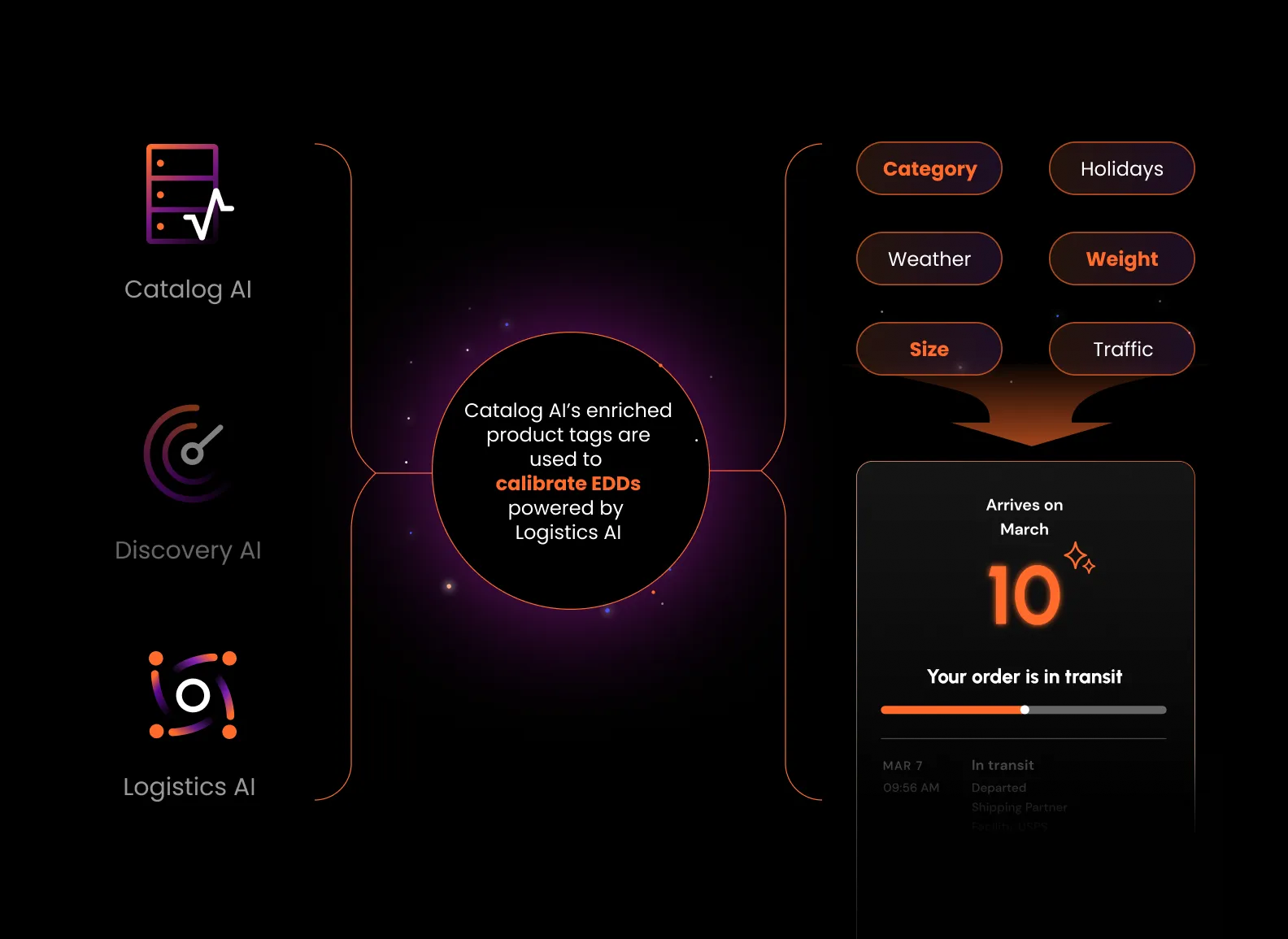

- Optimize logistics: eCommerce companies can build strong delivery networks and use AI for smarter logistics management. Leaning into Logisitcs AI is one of the ways to significantly improve operational efficiency.

- Harmonize regulations: Streamlining rules across the region can ease cross-border trade.

- Localize offerings: Understanding local cultures and languages helps businesses tailor their platforms and marketing.

- Boost cybersecurity: Strong cybersecurity measures are crucial for protecting consumer data and building trust.

By tackling these challenges with targeted strategies, eCommerce merchants in APAC can become more competitive and better serve diverse customers.

Looking Forward: A Bright Future for APAC eCommerce

As eCommerce grows in this dynamic region, businesses must stay on top of trends and consumer expectations. Embracing technology, optimizing logistics processes, and building trust through strong cybersecurity are crucial strategies for success. With these measures in place, the future of eCommerce in APAC looks bright.

In our next installment, we’ll examine the state of eCommerce in Latin American markets. Stay tuned!